It was the night before Alyona Mysko’s birthday when she got the word from her financial manager.

The founder of software company Fuel that provides financial planning for startups, Mysko was, she says, still working at home in Kyiv well into the night of July 22 when she learned that the company’s bank account was being cut off.

“(Tuesday) was my birthday, and the whole day was a situation,” she said. “It was a present from Mercury.”

Mercury is a U.S.-based fintech firm that provides banking services, specifically focusing on the startup market. It was a go-to for many firms with Ukrainian founders based both inside Ukraine and abroad. At the end of July, many of those firms were unceremoniously debanked.

According to Mercury, the decision to cut off services to Ukraine was a response to U.S. sanctions on Russian-occupied parts of Ukraine. Ukrainian founders were shocked at the move by a firm that had once wooed them with their Ukraine-specific service offerings.

They say that not only is Mercury punishing them for being invaded, but that the firm is being lazy in cutting off everyone to avoid any run in with sanctions violations.

Ukraine was not the only country hit in late July. Mercury no longer serves the Philippines, Nigeria, Haiti, or even EU member Croatia.

But affected Ukrainian founders took particular offense to Ukraine’s presence on a list of barred jurisdictions alongside heavily sanctioned jurisdictions — particularly Russia and Belarus.

Sanctions are the strictest bans that the U.S. government puts on banks — no transactions whatsoever, even on accident.

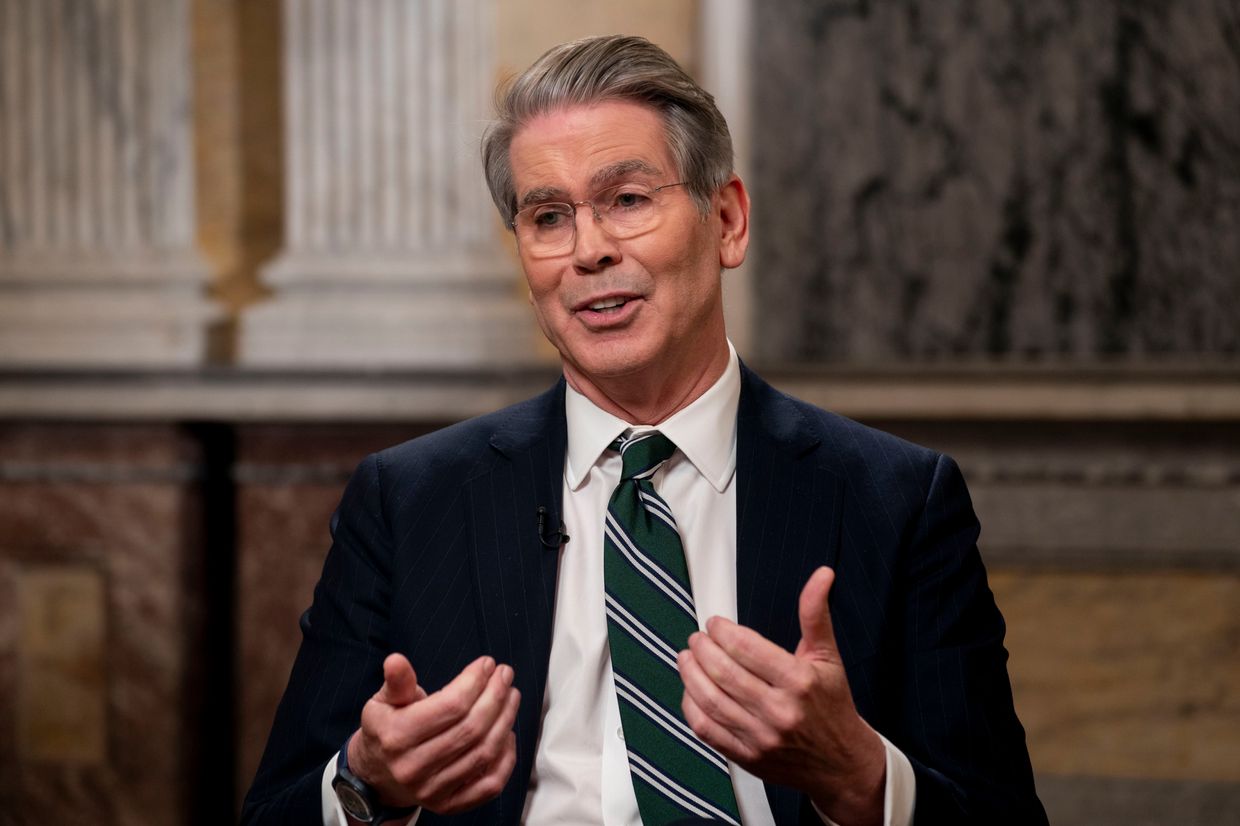

U.S. banks go far beyond sanctions in who they bar to avoid such accidents. The U.S. Treasury has tried to limit collateral damage for vulnerable populations — termed “derisking” — but it remains common practice for banks to cut their losses at any sign of trouble, says James Angel, an associate professor at Georgetown University’s business school.

“The problem with the bank compliance department is they're not paid to take risks,” Angel tells the Kyiv Independent. “Banking is fundamentally a thin-margin business. Big economies of scale. But one bad guy in the system can cause a huge amount of damage. So, a lot of banks do the arithmetic and say it's not worth the risk of dealing with this particular person or this particular geography.”

As around 20% of Ukraine is occupied by Russia, it is in the unique position of having territorial-level rather than country-wide sanctions.

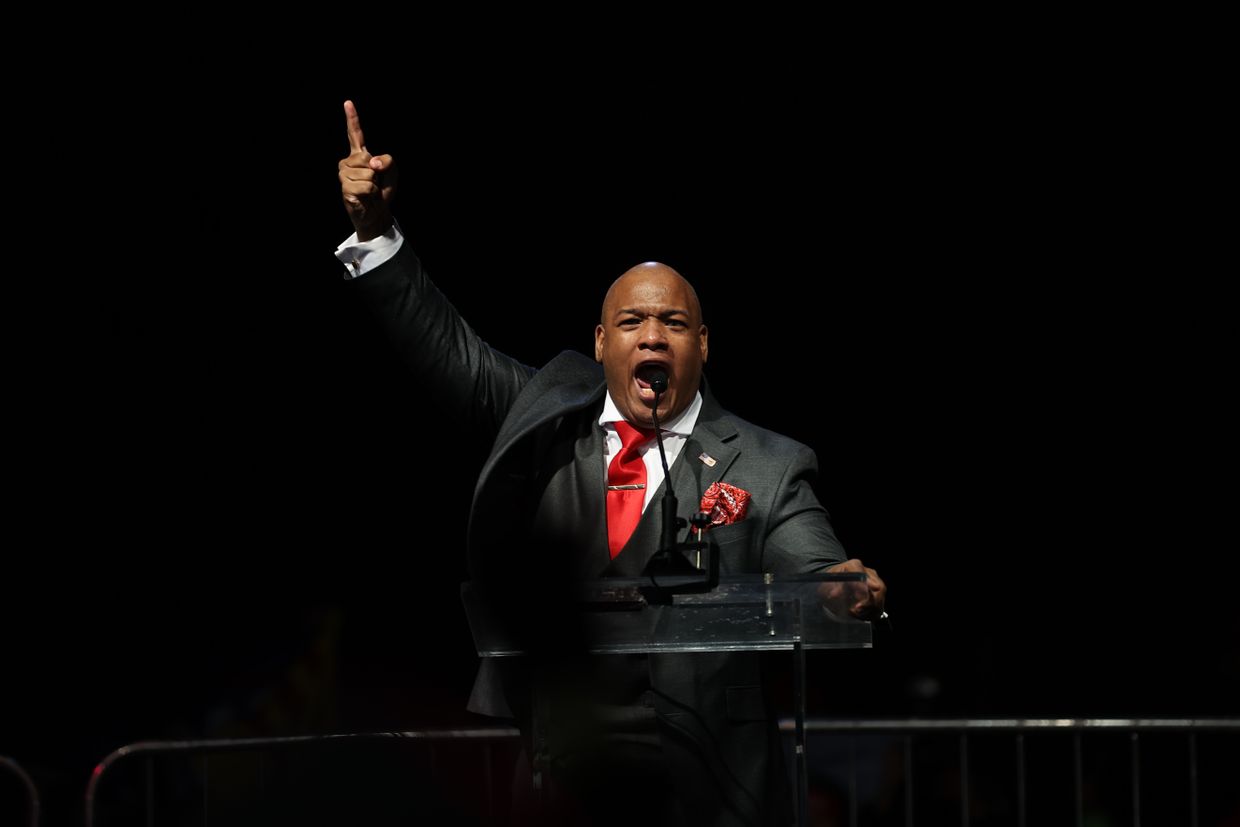

This causes particular complications, says Alex Zerden, who has worked at the Treasury’s Financial Crimes Enforcement Network, White House National Economic Council, and as a U.S. financial attaché in Afghanistan.

“You can have something that is compliant for most of Ukraine but then non-compliant at a sub-national level in those designated territories that are under Russian occupation,” Zerden says.

In a statement, a Mercury representative says the firm previously used a “region-based model” but that “compliance has become increasingly complex.” Some Ukrainians who found their accounts cut off say they weren’t based in Ukraine at all.

"The accounts being offboarded were identified based on business and residential addresses given to us during onboarding and regular Know Your Business (KYB) and Know Your Customer (KYC) refreshes, as well as frequent location of account activity (via IP addresses). Passports were not considered in these offboarding decisions," a Mercury representative wrote to the Kyiv Independent.

Banking in retrograde

Ukrainian startups have long faced issues with bank access in EU countries and the U.S., a critical hurdle to getting a business off the ground.

When Andriy Zinchuk was launching his venture firm ZAS in 2021, he recalls trying to get an account with the similarly startup-targeted Bridge Bank as “a nightmare of four months of diligence or conversations, just a never-ending story. We even delayed launching because of this bank issue.”

At the time, he was introduced to Silicon Valley Bank and Mercury.

“I decided to go with Mercury. They were more founder-friendly. And then they did this big PR campaign with Ukraine, saying that they will be integrated with Diia,“ says Zinchuk, referring to Ukraine’s digital portal for government services, from passports to taxes.

A key virtue of Mercury’s advertising in Ukrainian: Allowing people not physically based in the U.S. to get a U.S. account.

As with so many Ukrainian companies wooed by that earlier promise, Zas Ventures just got “derisked.” Zinchuk says Mercury’s reasoning is a cop-out.

“We are a multibillion-dollar company, and we are too lazy to figure out if you are in occupied territory or Ukraine-controlled territory, so we're going to cut you off as an entire country,” Zinchuk summarizes Mercury’s position. “Because we’ve got sanctions or something. But it's complete bullshit.”

A U.S. bank account is critical to service clients worldwide. Having one became a necessity following the start of the full-scale war, when capital controls made it impossible for Ukrainian banks to send money abroad.

Even before the full-scale invasion, there was no funding domestically, says Dominique Piotet. “There's no VC (venture capital) law in Ukraine. So when you're a startup, it's really hard or impossible to set up stock options and co-founders because it just doesn’t exist.”

A dual citizen of France and the U.S., Piotet runs the Ukrainian Phoenix Fund, a 50-million-euro VC fund that invests in Ukrainian-founded startups.

Mercury’s new policy of not serving clients in Ukraine is complicated by the fact that most “Ukrainian” companies are legally U.S. or sometimes U.K. or EU companies. Founders and staff may live all over the world. Porous relationships to borders make it harder for U.S. banks to tell who they trust and want to deal with.

Run on risk-on fintech

White House regulators have been on high alert for both fintech firms and high-risk tech banks since the banking crisis of early 2023. The Federal Deposit Insurance Corporation (FDIC) stepped in to back customer deposits far beyond the $250,000 required by law to stop a cascade of bank failures, including Silicon Valley Bank and First Republic.

Like many fintechs, Mercury has neither a U.S. banking license nor FDIC insurance, which backs customer deposits, nor a master account with the Federal Reserve. Mercury leaned into a partnership with Choice Bank, a small entity in Minnesota, as its partner to provide those networks.

Earlier this year, The Information published details of a meeting between the FDIC and Choice Bank, writing, “They scolded Choice for allowing overseas Mercury customers to open thousands of accounts using questionable methods to prove they had a presence in the U.S.”

Those accounts depended on registered agents based in the U.S. New laws and tightening regulations stateside clamped down on anonymous corporate registration in, for example, Delaware.

Unfortunately for Ukrainian startups, this has historically been the way they function — Delaware or Nevada corporations with staff primarily based in Ukraine, maybe with a founder or two in the U.S. or EU. Similarly, Ukraine’s economic dependence on the IT industry, the birthplace of most startups, is based on fairly simple principles: You can be anyone anywhere, and if you learn how to code, you can make decent money.

U.S. regulators have started fretting over the same border-agnosticism within the tech industry. North Koreans have periodically found gainful employment in the IT sector.

“Hiring someone who's in Donetsk, Luhansk, or who's a Russian or Belarusian national masquerading as operating in Ukraine is a major risk factor,” says Zerden of Ukraine’s IT startups.

Despite the inconvenience of Mercury’s sudden cutoff, Ukrainians interviewed were optimistic about finding options. Brex, Rho, and a resurgent Silicon Valley Bank were named as likely alternatives to Mercury for the time being.

“Keep looking,” James Angel advises Ukrainian startups. “Fortunately, we’ve got over 4,000 banks in the U.S. Even if bank #1 is too risk averse, one of those 4,000 banks will be going ‘hm.’”