Germany is now ready to support a U.S. plan to use future revenue of immobilized Russian assets to support $50 billion aid to Ukraine, Bloomberg reported on May 21, citing its undisclosed sources.

Washington's proposal envisions borrowing against future profits from the frozen assets and transferring the money to Kyiv upfront through a Group of Seven (G7) loan.

The plan, to be discussed during an annual meeting of G7 finance ministers in Italy later this week, could help disperse the funds as early as this summer.

While G7 members were initially skeptical of the idea, Washington's diplomatic push has reportedly managed to rally many of them behind it.

The more reluctant leaders warmed to the idea as a way to secure long-term financing for Kyiv in case Donald Trump, who has repeatedly criticized aid to Ukraine, returns to the White House after the November election, the Financial Times wrote.

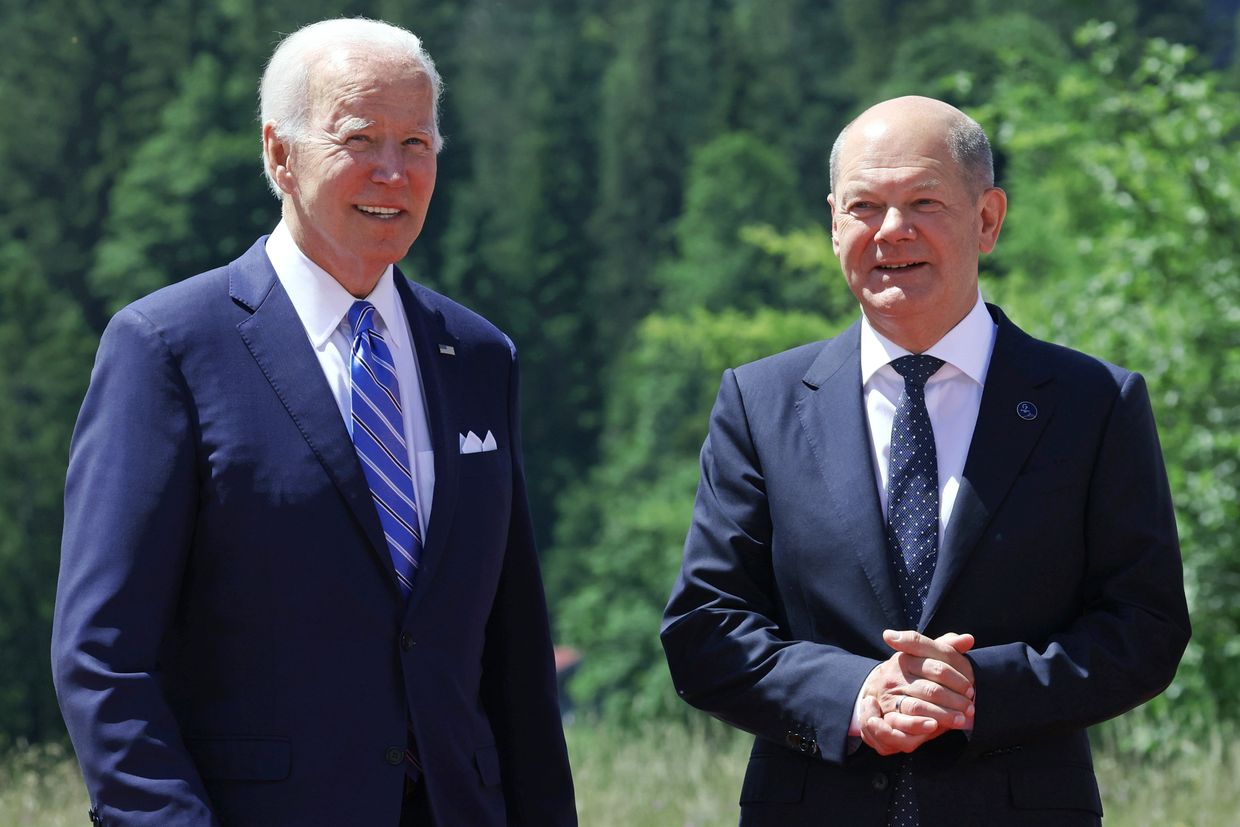

According to Bloomberg, Germany's change of heart could be a crucial step in securing sufficient support for the plan. German officials do not expect a final agreement until a G7 leaders' summit in Italy in mid-June, the outlet added.

Ukraine's Western partners and other allies froze around $300 billion in Russian assets at the start of the full-scale invasion in 2022. Roughly two-thirds are held in the Belgium-based financial services company Euroclear.

While the U.S. proposed seizing Russian assets outright, the EU has been more hesitant, fearing legal and fiscal pitfalls. Instead, Brussels seeks to use windfall profits generated by the frozen assets and funnel them to Kyiv.

Ukraine's needs for foreign aid only grow as Russia ramps up pressure along the front and aerial attacks against population centers and critical infrastructure. The costs of the country's reconstruction also continue to rise, amounting to $486 billion over a 10-year period, according to the World Bank's report from February.

Ukrainian officials have repeatedly called for the confiscation of Russian assets as a path to sustainable external financing that would not put pressure on partners' budgets.