The EU Council agreed to use profits from the frozen Russian sovereign assets to aid Ukraine, the Czech representation in the EU announced on May 21.

According to the statement, the proceedings could amount to between 2.5 billion and 3 billion euros ($2.7-3.26 billion) annually, with most of it allocated to Kyiv's military needs.

"Up to 3 billion euros ($3.26 billion) (could be raised) only this year, 90% goes for Ukraine's military. Russia must pay for its war damages," Czech Foreign Minister Jan Lipavsky said.

Ukraine's Western partners and other allies froze around $300 billion in Russian assets at the start of the full-scale invasion in 2022. Roughly two-thirds are held in the Belgium-based financial services company Euroclear.

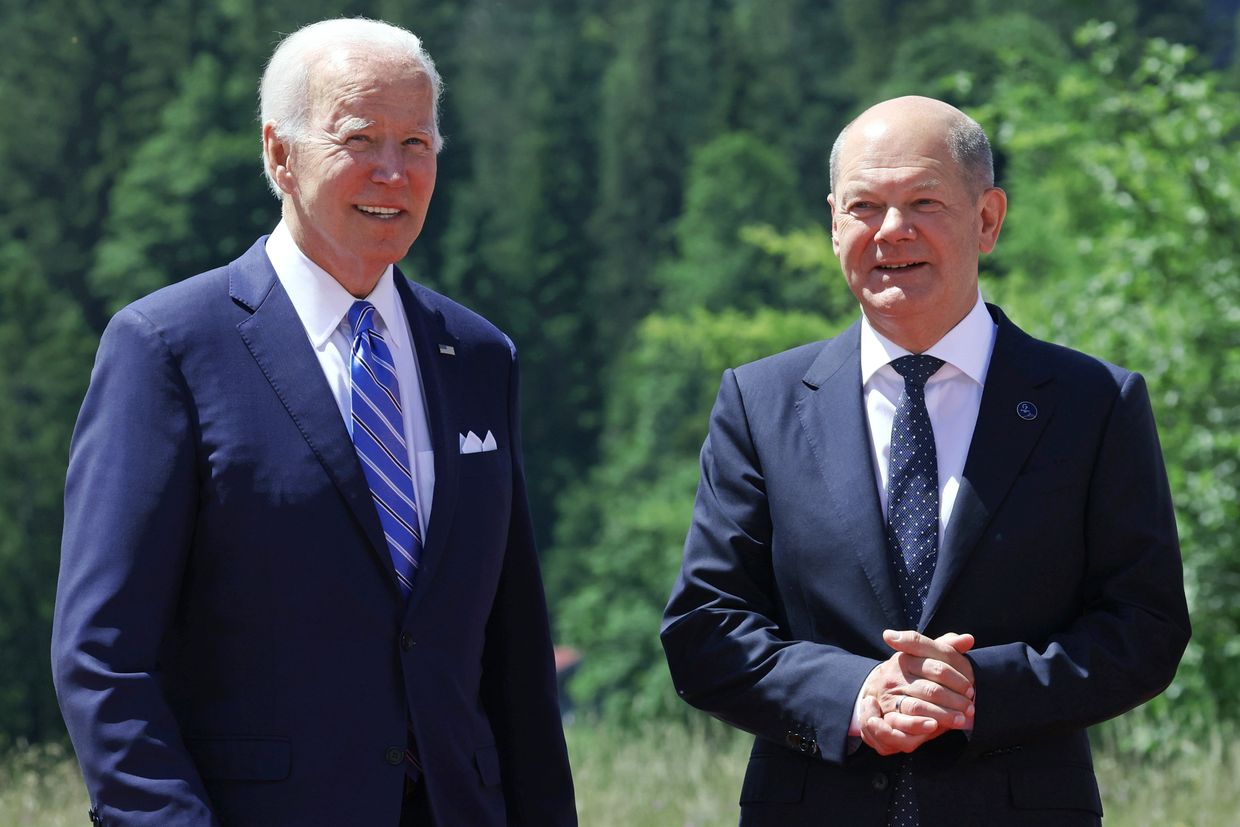

While the U.S. proposed seizing Russian assets outright, the EU has been more hesitant, fearing legal and fiscal pitfalls of confiscation. Instead, Brussels proposed to use windfall profits generated by the frozen assets and funnel them to Kyiv.

In March, the European Commission submitted a proposal on using 90% of the generated funds to purchase weapons for Ukraine and allocate the remaining 10% to the EU budget to support the country's defense industry.

After many weeks of debates, EU ambassadors reached a political agreement on the proposal on May 8.

Ukraine's needs for foreign aid only grow as Russia ramps up pressure along the front and continues in aerial attacks against population centers and critical infrastructure.

Ukrainian officials have repeatedly called for the confiscation of Russian assets as a path toward sustainable external financing that would not put pressure on partners' budgets.