French billionaire Xavier Niel’s investment company NJJ Capital is planning to acquire and merge two telecom businesses in Ukraine in what is set to be one of the largest acquisitions in the country’s history, bringing with it significant investment at a time when the war-torn country is struggling to attract foreign investors.

In a joint press release on April 8, NJJ said it had received regulatory approval in March from Ukraine's antitrust regulator to acquire one of Ukraine’s largest fixed telecom and pay-TV providers Datagroup-Volia.

Following regulatory approval, the company wants to also acquire Turkish-owned Lifecell, Ukraine’s third-largest mobile operator, the press release said.

Once the acquisitions are complete, Niel’s NJJ plans to merge Datagroup-Volia together with Lifecell to form a combined Datagroup-Volia-Lifecell entity, according to the press release.

The total value of the acquisition, including the purchase price and investment over the course of five years, will amount to $1.5 billion, Datagroup-Volia CEO Mykhailo Shelemba told Forbes in an interview published on April 11.

The acquisitions are the first major investments in Ukraine by a new market player since the start of Russia’s full-scale invasion and one of the most significant investments into the country's telecommunications sector by a Western investor.

As Russia’s war against Ukraine rages on and foreign investment trickles in, the merger is both a positive market signal for would-be private-sector investors and a marked step toward further integration with European markets.

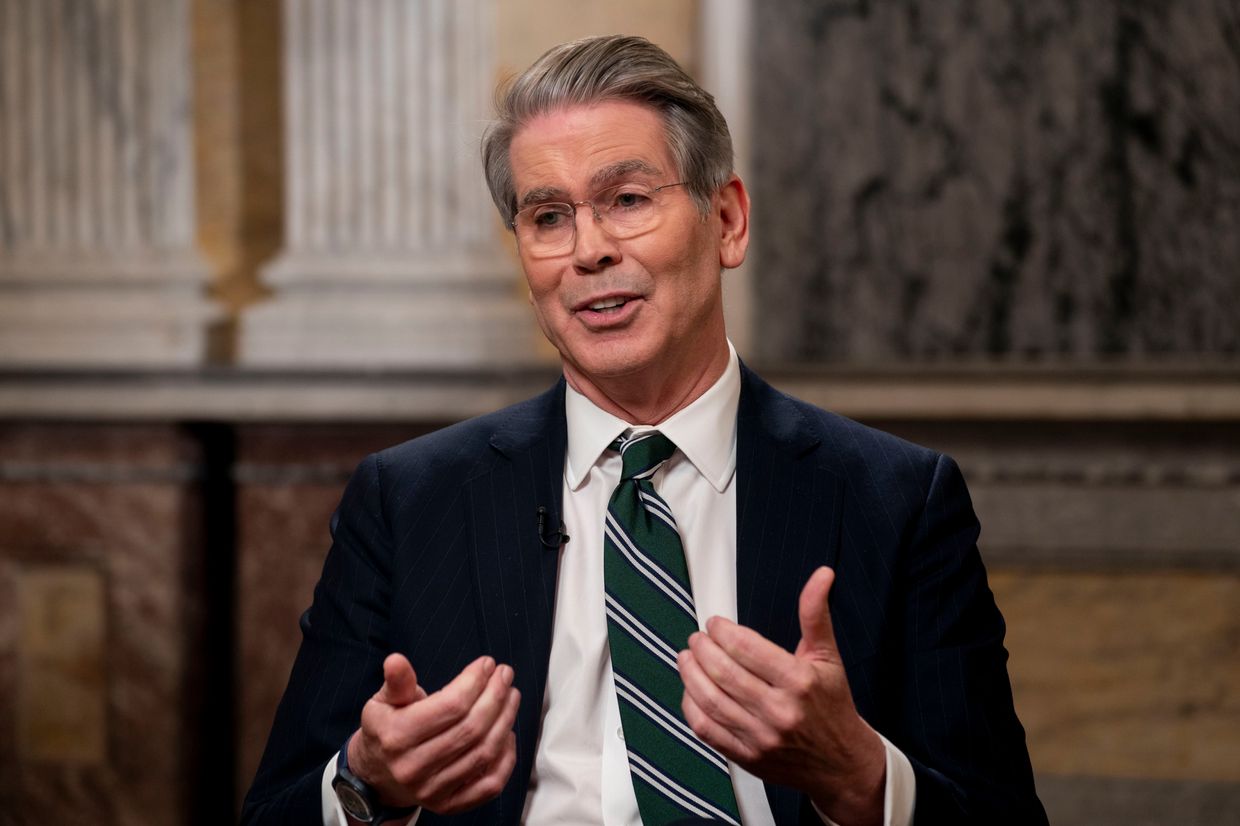

“We are confident that our landmark transaction will serve as a signal to others that the time to invest in Ukraine is now, to support the rebuilding of the country and realize its potential,” Niel said the press release, released jointly with the companies and U.S. private equity firm Horizon Capital whose fund majority owns Datagroup-Volia.

The purchase is also one of the largest acquisitions in independent Ukraine’s 33-year history since Indian Mittal Steel purchased the Kryvorizhstal complex for $4.8 billion in 2005 before merging with Arcelor a year later, and becoming ArcelorMittal.

In addition to regulatory hurdles, the deal is facing a battle in court over 19.8% of Lifecell shares owned by Russian oligarchs Mikhail Fridman, Petr Aven, and Andrei Kosogov that were frozen by Ukraine in October 2023.

Lifecell has appealed the decision, with an upcoming court hearing scheduled for April 16. If the court denies the appeal, and NJJ can't move forward with purchasing 100% of Turkcell’s three Ukrainian businesses, the entire deal could fall through.

“April 16 is the Rubicon for this deal and the largest M&A in Ukraine in the last 10 years. Without a positive decision on this case, the deal will not take place,” Shelemba told Forbes in an interview published on April 11.

It was first reported in January that Turkey’s largest telecommunications company Turkcell would sell its Ukraine units, which include Lifecell, outsourcing contact center Global Bilgi, and tower service provider UkrTower, to NJJ for an estimated $525 million.

Later in February, it was reported that NJJ was also eying the purchase of Datagroup-Volia, formed in 2021 after Datagroup acquired 100% of Volia Group.

Russia’s full-scale invasion has damaged or destroyed thousands of base stations and fiber optic lines around the country. Others have been lost to Russia’s ongoing occupation.

NJJ’s capital expenditures as part of the deal will involve crucial investments in network, licenses, equipment, expanding fixed and mobile infrastructure in Ukraine, as well as building out 5G in Ukraine, which the government approved a plan for in 2020.

Ukraine’s Digital Transformation Minister has said the ministry was working with companies to get 5G off the ground in 2024.

Niel, whose investments span Europe, Africa, and Latin America, is considered a pioneer in the telecom market. His telecom giant Iliad, which owns one of France’s largest internet providers Free, also announced big investments into artificial intelligence last year.

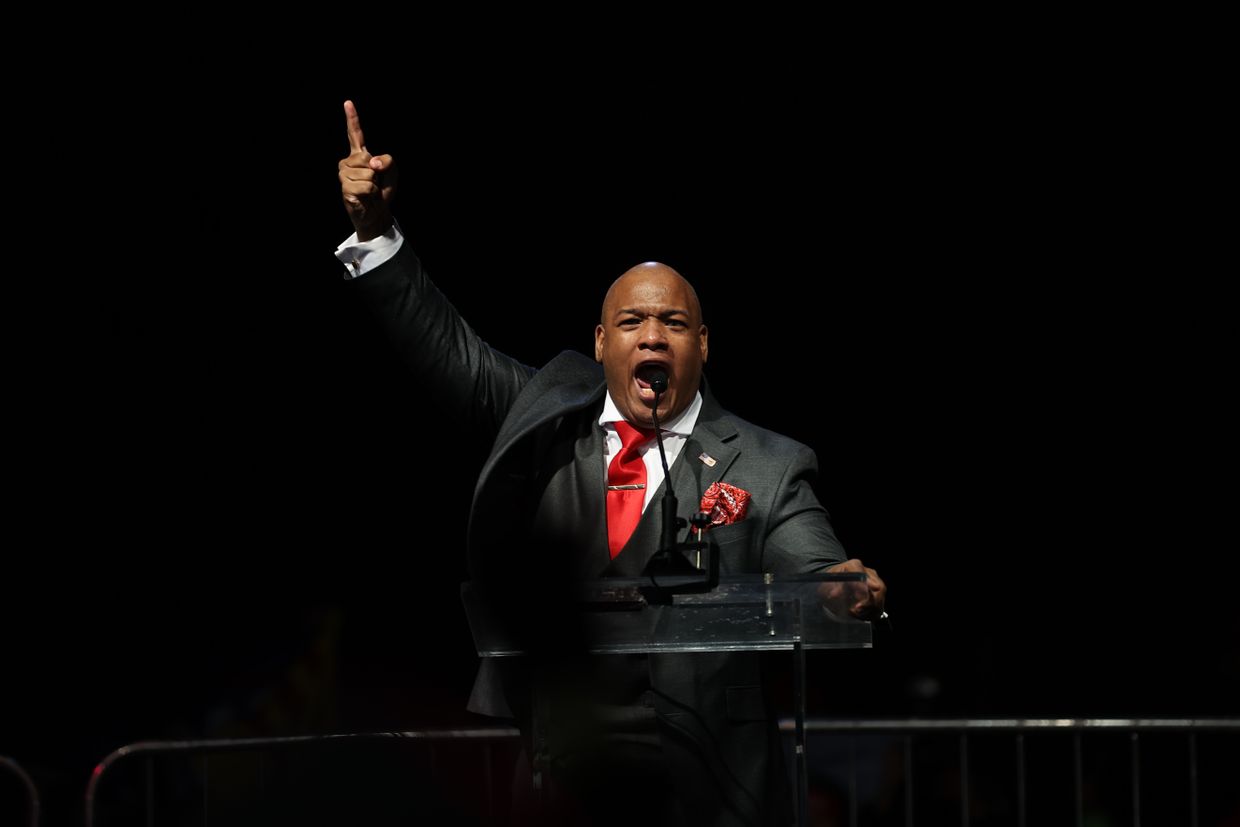

Horizon Capital CEO Lenna Koszarny along with Shelemba met Niel in December 2021 with the idea to pursue a triple play, bringing fixed, pay TV, and mobile together — an idea that was born in 2018 with the first meetings between Volia and Lifecell, Koszarny said in the joint press release.

The idea was inspired by Niel, who over 20 years ago invented the Freebox, the world’s first triple-play box, according to Koszarny.

That vision was part of a long-term strategy set out by Koszarny and Shelemba when Horizon Capital first invested in Datagroup in June 2010. Horizon decided to go from a minority stake to a controlling stake in Datagroup in 2016, Koszarny said in the release.

After Shelemba was brought on to Datagroup as CEO in 2016 from McKinsey Dubai, the company along with Horizon moved to acquire Volia, which was completed in 2021.

Datagroup-Volia is 96.13% owned by a fund managed by Horizon Capital and 3.87% by Datagroup-Volia CEO Mykhaylo Shelemba.

Datagroup-Volia is the largest player in Pay-TV, corporate, and wholesale fixed telecom segments in Ukraine, and the second largest player in high-speed retail broadband, with around 34,000 kilometers of 5G-ready, nationwide fiber infrastructure.

Lifecell is the third-largest mobile operator in Ukraine, behind the country’s largest mobile service provider Kyivstar, and Vodafone Ukraine.

Kyivstar is owned by Netherlands-based company Veon, in which Russian sanctioned oligarch Mikhail Fridman holds a stake. Vodafone Ukraine, part of the British multinational Vodafone group, is fully owned by Azeri NEQSOL Holding.

Lifecell is the only of the three to have seen its active subscribers grow since the start of the full-scale invasion, increasing 16.5% year-on-year from 9.9 million to 8.5 million in 2023, according to a company press release.

Kyivstar’s subscriber base decreased by 2.6% year-on-year to 24.1 million from 2022-2023, while Vodafone’s subscriber base was at 15.2 million by the second quarter of 2023 — an 8% decrease compared to the second quarter of 2022, the companies said in press releases.

“Once remaining conditions are met for the acquisition of mobile assets in Ukraine, trading under the Lifecell brand, the parties intend to create a national telecom champion, with the highest growth profile among peers, and the ‘operator of choice’ for safe, secure and reliable telecom services in Ukraine,” the companies said in the joint press release.

The combined platform will have around 5,000 employees and 11 million customers, a source involved in the deal told the Kyiv Independent.

Horizon Capital will remain a minority investor in the merged entity. Shelemba will also remain a shareholder and will head the combined Datagroup-Volia-Lifecell platform.

Ukraine’s antitrust regulator is currently reviewing the Lifecell acquisition and once approved, the deal is set to close, according to the source.

This article was updated on April 11.