The European Bank for Reconstruction and Development (EBRD) and International Finance Corporation (IFC) provided $435 million to support investment in Datagroup-Volia-Lifecell, a recently merged Ukrainian telecom company owned by a French billionaire, according to a statement from Oct. 10.

This is the single biggest direct foreign investment in Ukrainian business since Russia's full-scale invasion began in 2022.

"The project is expected to send a strong positive signal to investors," EBRD's statement read. The initiative will be supported by the French government and the European Commission.

Datagroup-Volia-Lifecell, the product of a historic merger of Datagroup-Volia and Lifecell via an acquisition by France's NJJ Capital, will receive $217.5 million from each organization.

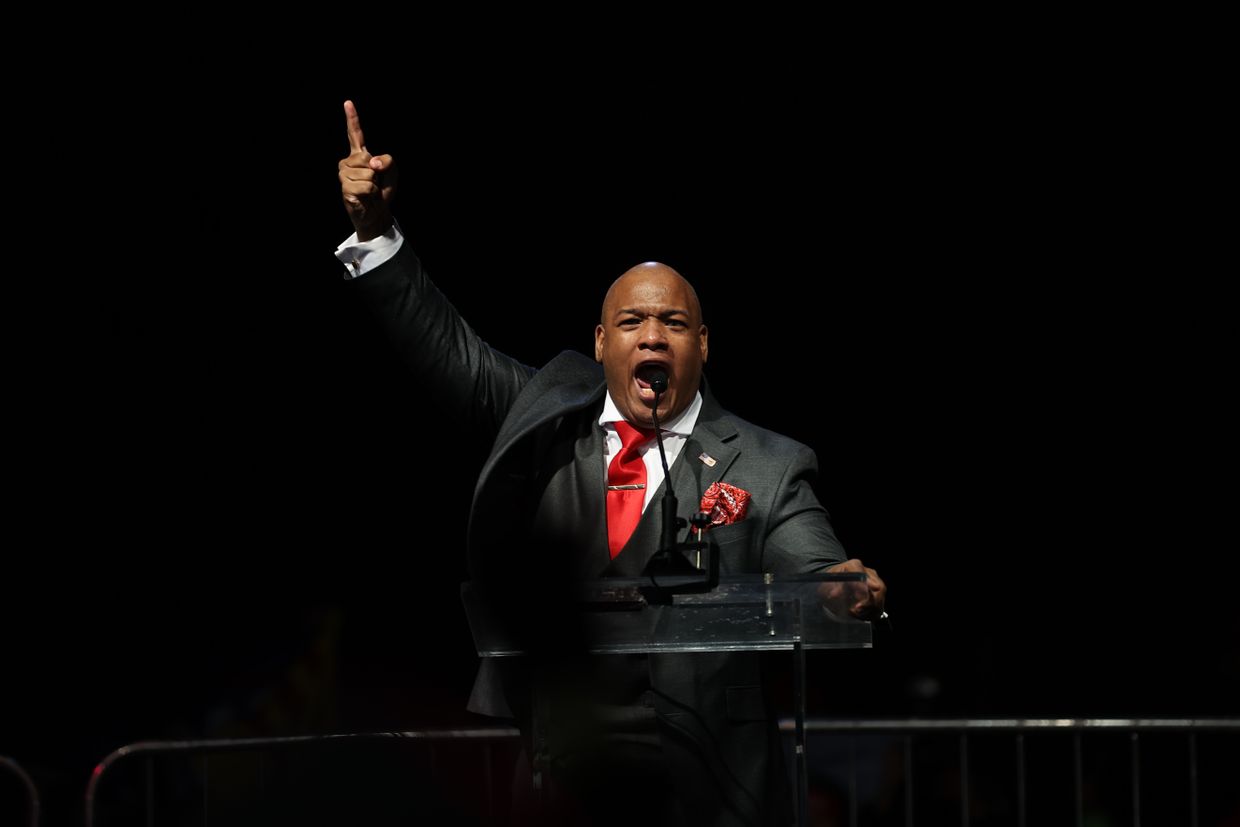

NJJ Capital is owned by Xavier Niel, an influential French investor involved in telecommunications, technology, and media. The French company has partnered with Horizon Capital, a U.S.-Ukrainian private equity firm, and Mykhaylo Shelemba, former CEO of Datagroup-Volia and now CEO of the new group.

According to EBRD's statement, after the investment, Datagroup-Volia-Lifecell will deliver improved mobile connectivity to 10 million subscribers and provide faster and more reliable fixed broadband access to around 4 million homes.

The project will also support the telecoms sector recovery from the estimated $1.9 billion in direct damages and $750 million in losses caused by Russia's full-scale war, the statement read.

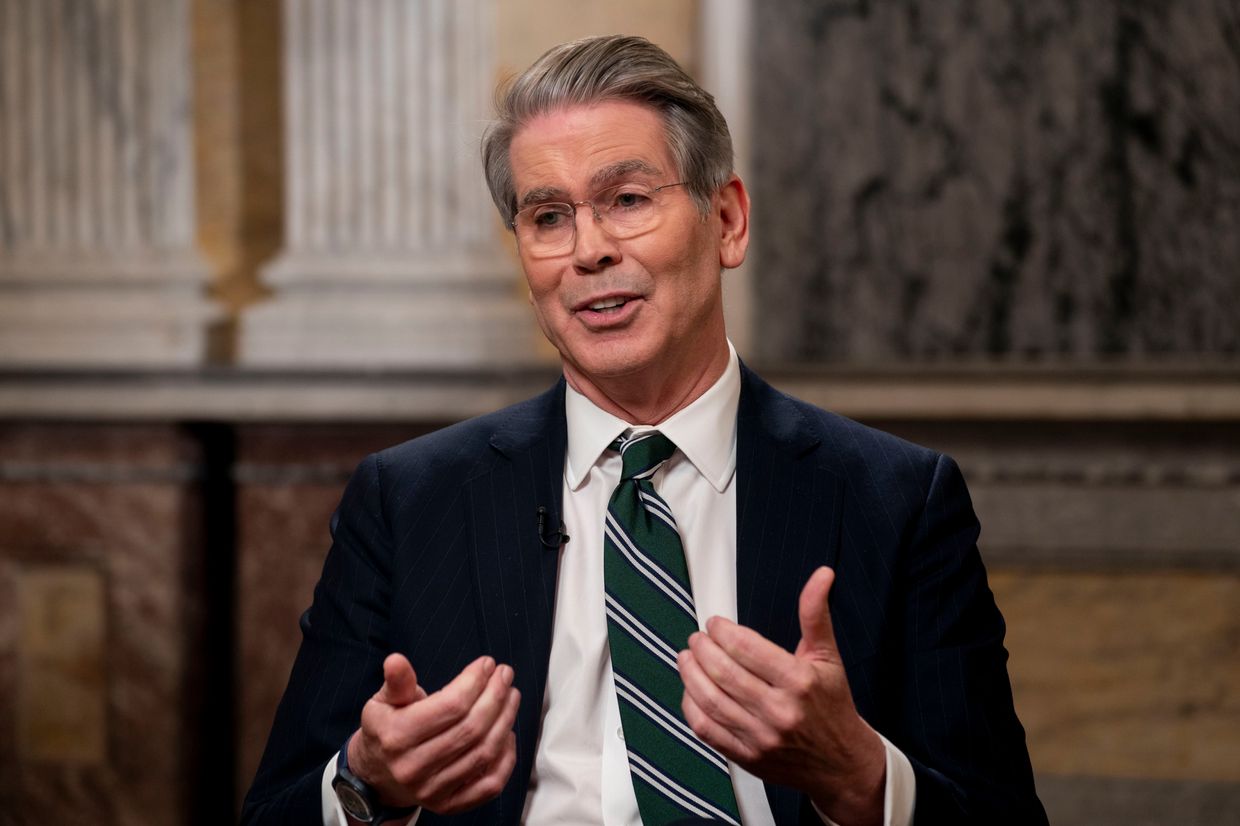

"The telecoms sector has been essential to Ukraine's welfare and economic resilience since the war began," EBRD Vice President Mark Bowman said.

"This operation will result in a large and reliable telecommunications operator, important domestically, as well as a very significant international investment in the Ukrainian economy, which we are proud to be part of."

Originally set up to help central and eastern Europe transiting to a market economy at the end of the Cold War, EBRD gives loans to strategically critical sectors in countries battered by war or economic hardships.

IFC, a member of the World Bank, also invests in sectors in developing countries to fulfill basic humanitarian needs.

Since the start of the all-out war in Ukraine, EBRD has deployed 5 billion euros ($5.5 million) in the country with a focus on energy, infrastructure, food security, trade, and the private sector.

The EBRD's board has approved an additional hike of 4 billion euros ($4.4 billion) to support further investment at this level in wartime.