Within weeks of U.S. President Donald Trump saying he wanted to do a deal with Kyiv on its “rare earths and other things,” it became clear the U.S. wasn’t just interested in Ukraine’s critical minerals and rare earth elements.

U.S. Treasury Secretary Scott Bessent visited Kyiv on Feb. 12 to present a deal to President Volodymyr Zelensky. After the Ukrainian president refused to sign citing a lack of security guarantees in it, details of the proposed agreement began to surface, setting off a wave of panic the U.S. was asking for too much.

According to several reports and a leaked version of the deal, the U.S. was looking for a 50% interest in mineral resources, oil and gas resources, ports, and other infrastructure through a joint investment fund. Such a deal would potentially include some of the country’s largest companies, including state-owned oil and gas giants.

The proposal, particularly for stakes in Ukraine’s large oil and gas sector, hasn’t gone over well. Reactions to the deal have included calling it "colonial," and amounting to asking a country that was invaded to pay reparations, and to its ally.

“We are not a colony, and there are no other examples of when allies demanded (this) in the middle of the war from their friends. The proposal definitely looks like reparations,” said Yaroslav Zhelezniak, a Ukrainian MP.

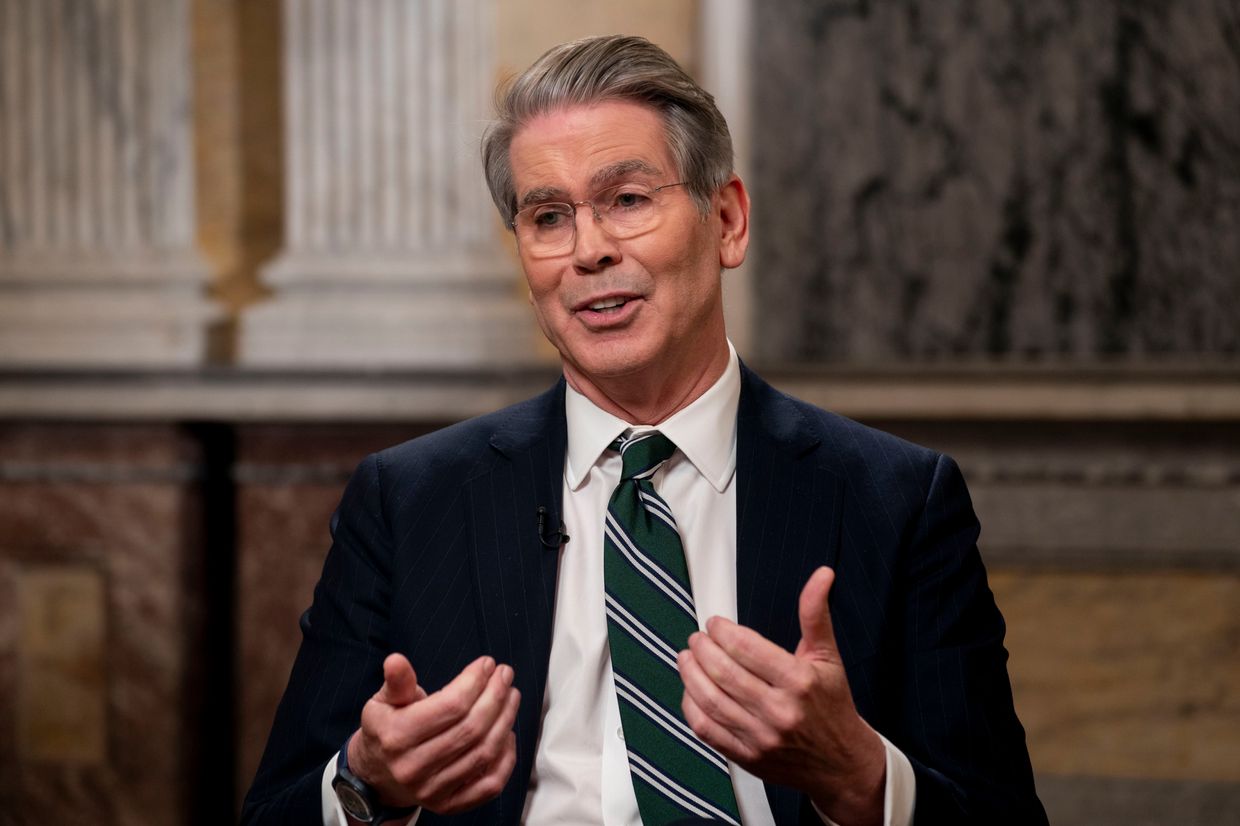

The deal is, however, likely just in its early phases. It could be that the Trump administration started the negotiations by asking for a lot with the expectation that the two sides will meet somewhere in the middle, said the President of the American Chamber of Commerce in Ukraine, Andy Hunder, who is familiar with the deal.

“The new administration team came in like a bull into a china shop. So yeah, of course, they're going to break some cups and plates.”

Reuters reported on Feb. 20 that the White House may opt for a simplified agreement with details sorted out down the line.

If a happy middle ground is found, business people in Ukraine and experts believe the deal could be an opportunity to inject fresh capital into Ukraine’s economy, particularly some of its struggling state-owned companies.

“Our understanding was that the (proposed) deal would help professional fund managers bring better returns to state-owned enterprises — many of which have been mismanaged over the past number of years,” said Hunder.

A deal that includes more than Ukraine’s mineral resources or rare earth minerals, may also be due to the fact that the actual volume and value of Ukraine’s critical minerals are hugely speculative and hotly debated with official figures based on optimistic Soviet estimates of $12 trillion.

On the flip side, Ukraine is known to be rich in natural gas and its ports are strategically located on the Black Sea at the crossroads between Europe and Western Asia.

Win-Win?

Despite the public outcry against the deal, Kyiv isn’t casting it aside. In addition to looking to tie any agreement on resources to security guarantees to bolster its defense, Ukraine’s struggling economy needs investment.

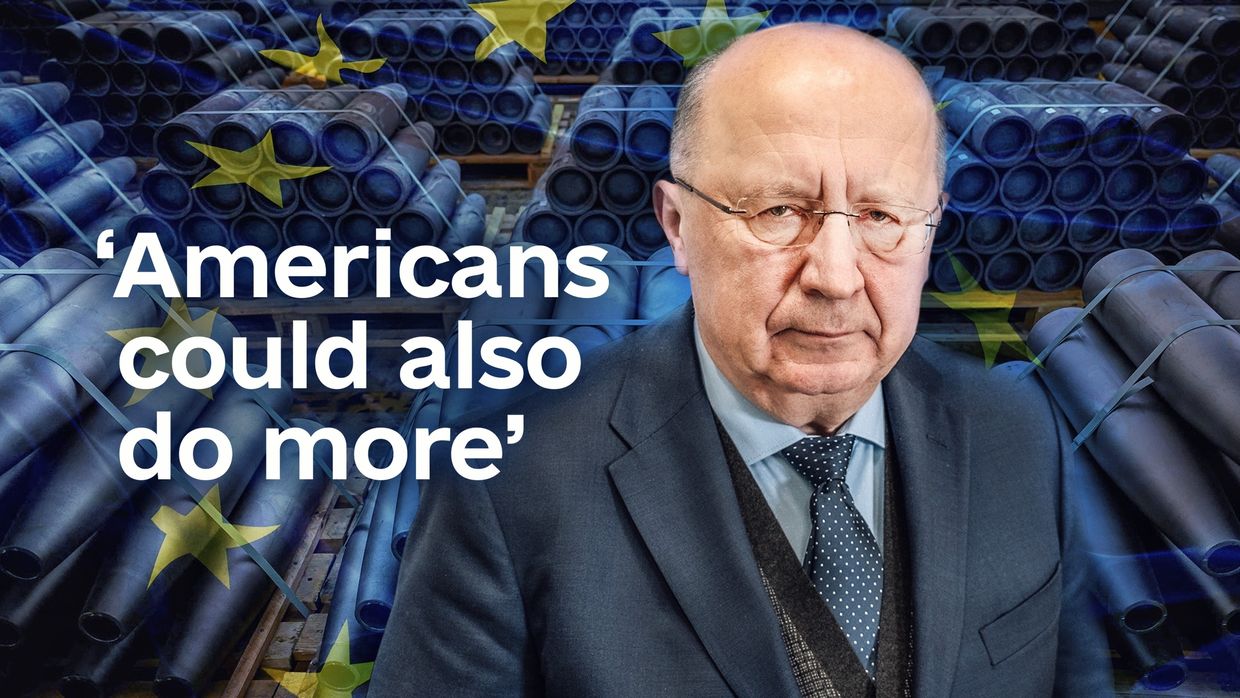

If done right, the deal could be a win-win situation for both Ukraine and the U.S., said Oleksandr Kharchenko, managing director of the Energy Industry Research Center, a consultancy in Kyiv.

“In any kind of development in the Ukrainian oil and gas sector, we need money and technology. It's not something which you can take and it will generate profit. You have to invest a lot to make money in this business,” he said.

Ukraine’s energy sector is lucrative. State oil and gas giant Naftogaz earned 32.4 billion hryvnia ($779 million) in profit in the first nine months of 2024. DTEK, the largest private energy company, earned a gross profit of Hr 4.6 billion ($111 million) from oil and gas production in the first half of 2024, despite the war.

State-owned companies have a checkered history of corruption and mismanagement. Large parts of Ukraine’s economy have long been dominated by oligarchs. U.S. investors in Ukraine’s state-owned enterprises could lead to positive corporate reforms and attract more money, Kharchenko said.

More financing and access to American technology will boost Ukraine’s oil and gas production, he noted. In turn, Ukraine will have more gas to sustain itself, expand its influence on the gas market, and help replace Russian gas in Europe, an issue that persists despite the EU’s efforts to diversify.

While it would be "beneficial for international players to come in, Ukraine’s interests should be preserved" in any deal, said a representative of a Ukrainian energy company, speaking on condition of anonymity.

Zelensky has batted away the idea of Ukraine becoming a piggy bank for countries exploiting its natural resources. Speaking to CNN Turk on Feb. 19, he emphasized Ukraine wants to be "friends and partners" rather than a “center for the extraction of raw materials for any continent.”

One path is offering investment opportunities in return for the liberation of occupied territories, where resources like lithium and gas are located.

“It's wise to propose the large share of (occupied resources) to the U.S. if they are able to help us to liberate them,” said Zhelezniak.

The question still remains of how the U.S. will offer protection guarantees in the long run although NBC reported that Washington may deploy troops to guard the resources. There is an underlying concern that Trump is not interested in the security of Ukraine as a whole but instead seeking to exploit a vulnerable ally.

“It is not in anyone’s interest to see Ukraine in the future being a devastated land under constant missile and drone bombardment by Russia, with a few plants or resource sites guarded by U.S. special forces — like what we saw in Iraq and Syria until very recently,” said Roman Sulzhyk, a partner at Ukraine Breakthrough Investments, an investment firm.

“A more equitable deal would involve only future revenue, from resources developed with U.S. investment and expertise, and tangible security guarantees — not just for the sites where Americans operate, but for the whole country,” he added.

Unclear messaging

Part of the reaction to the deal may be due to its messaging. If the Trump administration had presented the deal as a concession or a private-public partnership (PPP), it would have offered a different understanding, Hunder said.

“If you come along and say: ‘give us this,’ then it’s going to be perceived very differently.”

Ukraine is no stranger to PPPs. Big institutions like the International Finance Corporation (IFC) have overseen billions of dollars in projects in the last decades including in the energy and transportation sectors.

Zhelezniak agrees that overall, joint ventures of some kind are “a good idea.”

“But it’s better to just privatize (state enterprises) and sell them to foreign investors,” he said, referencing the sale of UMC Titanium, a state titanium producer that was sold to Cemin Ukraine in October 2024.

Since investments in natural resources are a long-term commitment rather than a short-term gain, Zhelezniak emphasizes the need to ensure the agreement is clear and sustainable. It shouldn’t be vulnerable to revisions when new governments come into Washington and Kyiv.

There is also a legal question. The U.S. proposed governing the deal under New York law, but that could change. Establishing how any part of the deal would be governed will be key, especially given the Ukrainian court system's bad reputation.

Moreover, Ukraine’s constitution states the resources belong to the people so it is unclear whether the president has the power to even make this type of deal. Doing so could require constitutional changes.

Any deal will “have to be ratified and explained to the Ukrainian people. If not, it will create a lot of noise, and zero investments,” said Zhelezniak.

Liliane Bivings contributed reporting.