The private financing arm of the World Bank plans to invest $1.9 billion in projects in Ukraine over the next 18 months, Reuters reported on April 22.

According to its website, the International Finance Corporation (IFC) is the "largest global development institution focused exclusively on the private sector in developing countries."

Since the launch of Russia’s full-scale invasion, it has already invested $1.1 billion in Ukraine.

The new funding will go into projects such as river transport on the Danube or energy generation from solar and wind.

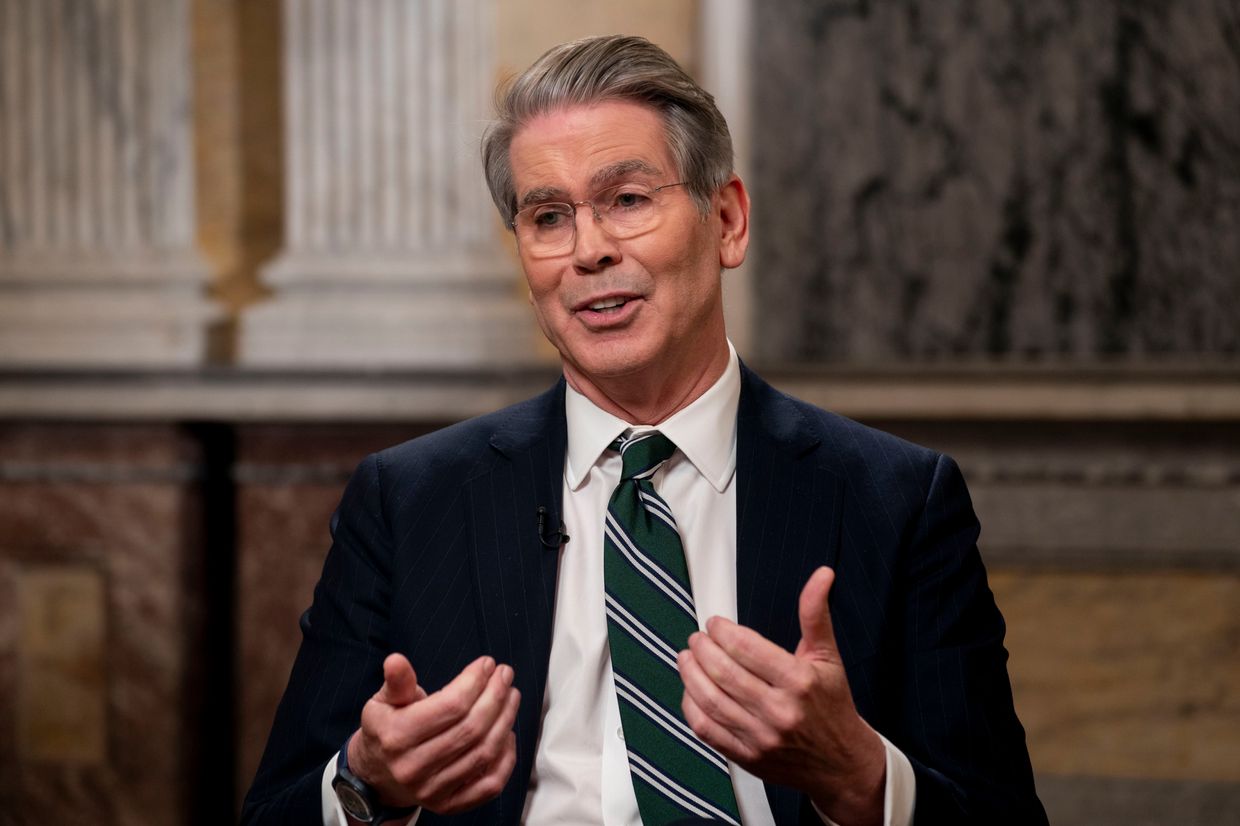

"It will allow us to start looking at investments that are longer-term in nature and more focussed on capital expenditure, so higher-risk - because these are assets that might actually, unfortunately, be damaged as conflict continues," Lisa Kaestner, the IFC's regional manager for Ukraine, told Reuters.

The investment will be a welcome boost. Despite its economy steadily improving from the first months of the full-scale invasion, very little foreign capital is currently trickling down to Ukraine’s private and public sectors.

Money from international financial institutions has helped stabilize the economy, bolstering forecasts of 3.2% gross domestic product (GDP) growth this year, according to the World Bank.

Private investors are still hesitant in the face of a protracted conflict, and war risk insurance programs have failed to persuade most.

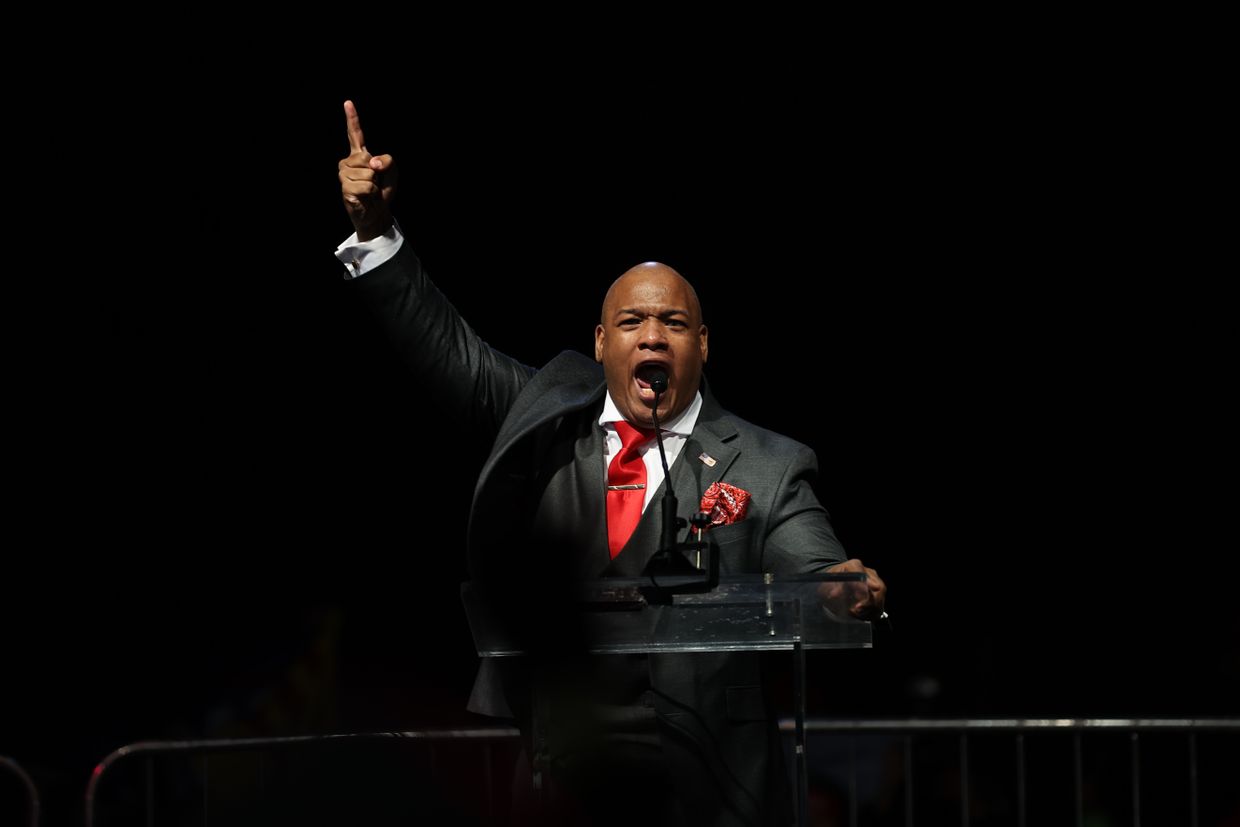

"It's impossible to expect investments during the war. The risk of war is so huge," Serhii Fursa, the deputy managing director at investment firm Dragon Capital, told the Kyiv Independent in February.