Russia's Central Bank decided on Dec. 20 to keep its benchmark interest rate steady at 21%, contrary to expert expectations of an increase, Russia’s state-owned TASS news agency reported.

To rein in accelerating inflation fueled by war spending, Russia's Central Bank has been raising its interest rate from 7.5% in July 2023 to the current 21% - the highest level since the early 2000s.

The tight monetary policy of Elvira Nabiullina, the Central Bank's chief, has drawn criticism from businesses in Russia's military-industrial complex. On Dec. 19, Russian President Vladimir Putin also mentioned the problem, saying that some experts believe that the central bank should have started using tools other than rate hikes to fight inflation.

Most analysts, including those polled by Russian media outlet RBC, anticipated a hike of 200 basis points to 23%.

Ahead of the decision, major Russian banks raised savings deposit yields to 24-25% per annum, reflecting expectations of tighter monetary policy.

The Central Bank said that, based on inflation and credit trends, the feasibility of raising the rate further would be assessed at its next meeting.

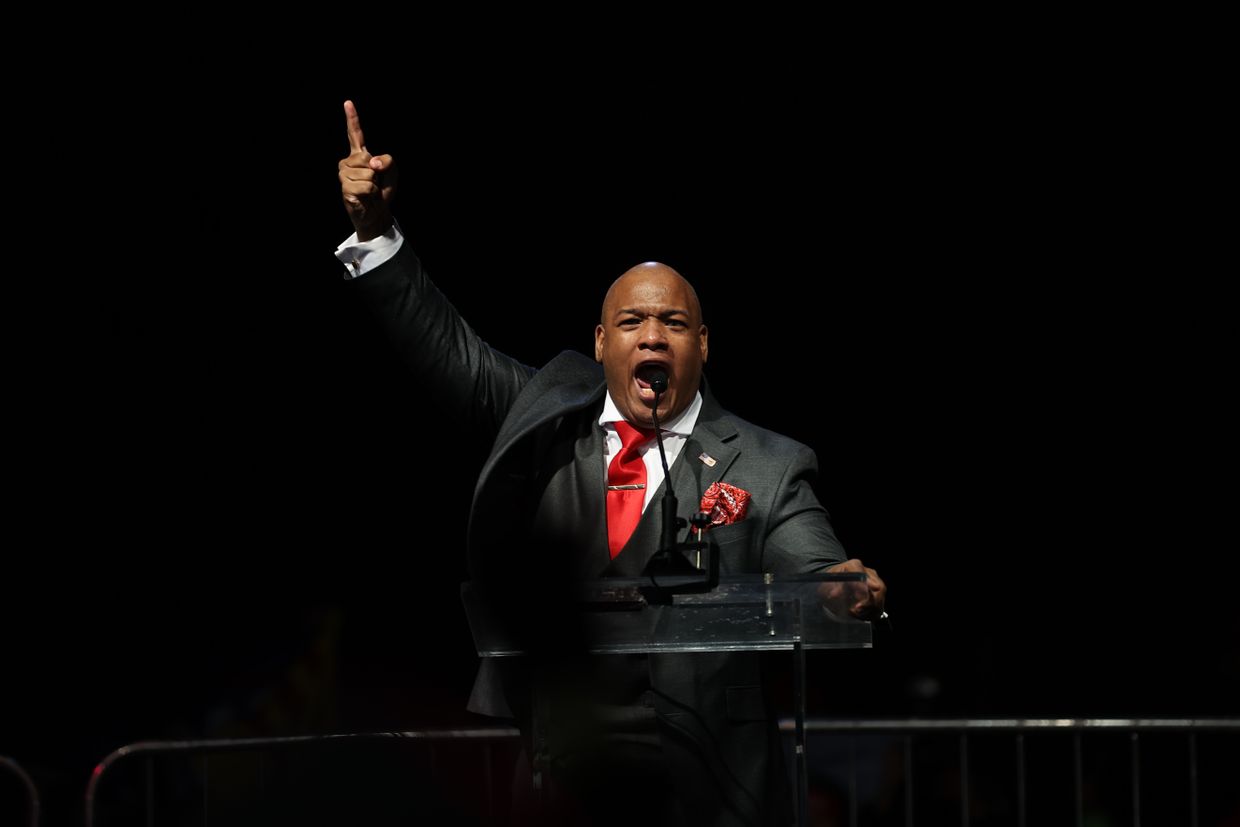

Nabiullina has been involved in a conflict over rate hikes with Sergei Chemezov, the influential CEO of the state-owned defense giant Rostec.

"If we continue working this way, most enterprises will essentially go bankrupt," Chemezov said in October, commenting on increases in the Central Bank's rate.

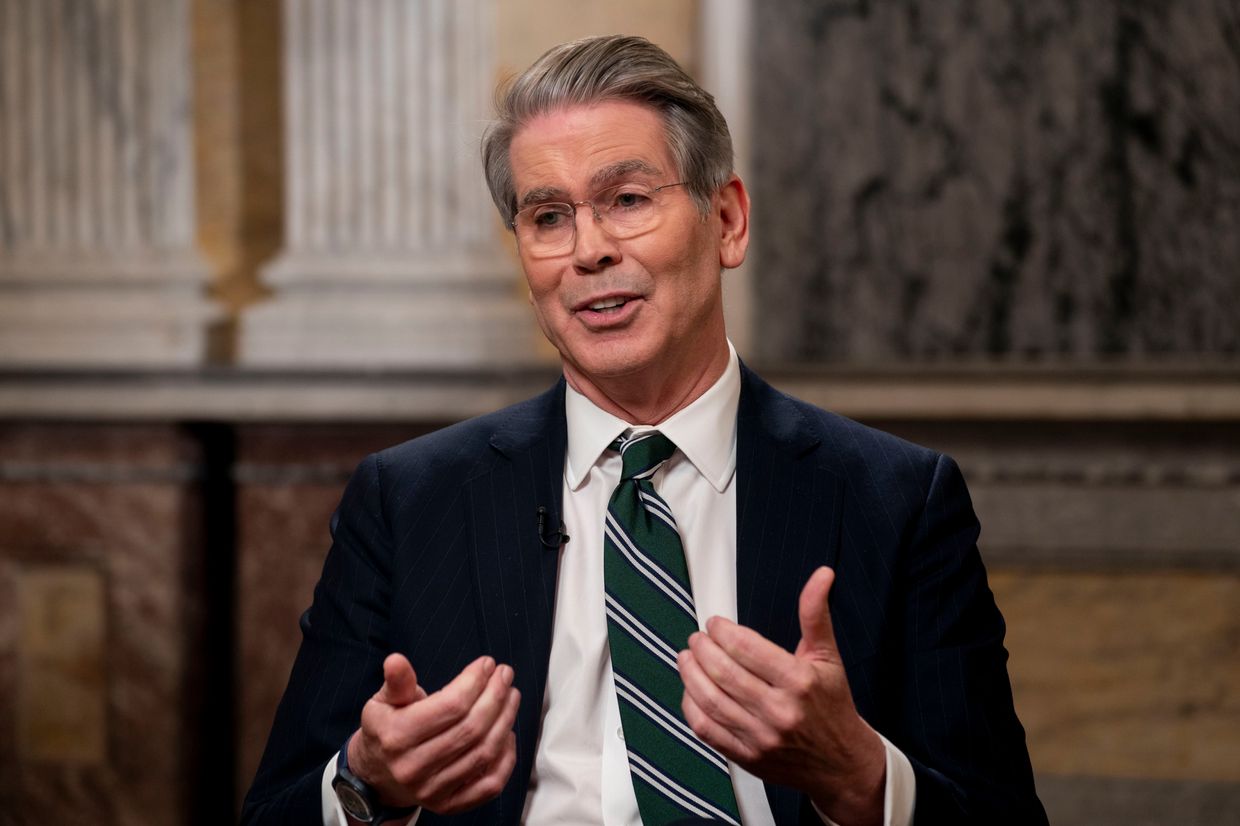

Former economic advisor and opposition politician Vladimir Milov told the Kyiv Independent in November that both sides have valid concerns.

"Chemezov is right that businesses will have to shut down at such a (high interest) rate," he told the Kyiv Independent, "Nabiullina is right that the rate cannot be cut because in that case there will be hyperinflation like in Turkey."

He continued that "there is only one way out — finish the war and withdraw Russian troops" from Ukraine.

The balance between controlling inflation and maintaining economic stability remains a critical challenge for Russia’s Central Bank, as the war economy continues to strain the nation's financial system.