Editor’s Note: This is issue 151 of Ukrainian State-Owned Enterprises Weekly, covering events from Oct. 6-12, 2024. The Kyiv Independent is reposting it with permission.

Corporate governance of SOEs

Ukrzaliznytsia’s CEO Yevhen Liashchenko filed a resignation letter, the company’s supervisory board said on Oct. 7. The board added that it planned to consider the resignation according to the applicable procedures in the coming days. There was no news on the results of that consideration at the time of writing.

Formally, for Ukrzaliznytsia, it was the Cabinet of Ministers that decided on CEO appointments and dismissals on proposal of the supervisory board, meaning that Cabinet could not appoint or dismiss the CEO without such a proposal. The SOE law changed significantly in February 2024 (see our Issue 120), and it is the supervisory board’s exclusive power now.

As we wrote in Issue 80, on March 21, 2023, the Cabinet of Ministers appointed Yevhen Liashchenko as Ukrzaliznytsia’s new CEO for the next two years to replace Oleksandr Kamyshin, who had become the new strategic industries minister. In September 2024, Kamyshin stepped down from his ministerial post and is now a presidential advisor and member of Ukrzaliznytsia’s supervisory board (see our Issue 146).

Previously, Liashchenko served as Ukrzaliznytsia’s executive board member, responsible for finance.

There were no public comments from Liashchenko on his resignation; however, several reputable media — including Ekonomichna Pravda (EP) and Forbes Ukraine — suggested several possible reasons.

According to EP, the resignation coincided with the appointment of Oleksiy Kuleba as the new deputy prime minister for restoration — minister for communities and territories development, who is now responsible infrastructure sector, and Kamyshin’s return to Ukrzaliznytsia as a supervisory board member. After his resignation, Liashchenko would return to the position of an executive board member until the end of his contract, i.e., for another six months, the media outlet added.

According to EP’s sources, the reason for Liashchenko’s resignation is also connected with Ukrzaliznytsia’s new priorities, primarily to raise funds for capital investments, including the modernization of the company’s infrastructure and rolling stock.

Forbes Ukraine’s sources also confirmed this. “Liashchenko was supposed to stabilize the company, and he did that. Now the company faces new challenges and needs a different person. Ukrzaliznytsia needs a completely different pace of change. It needs to accelerate,” the media’s source at the Cabinet of Ministers said.

One of the possible reasons for Liashchenko’s resignation is that he failed to adequately communicate the need for raising freight tariffs to businesses. Without this, Ukrzaliznytsia would not be able to achieve financial stability, the source added.

As we reported in Issue 72, Ukrzaliznytsia incurred losses of Hr 10.8 billion in 2022 (318 million euros at that time). The loss from passenger transportation was Hr 13.3 billion (391 million euros at the time), suggesting that the company’s other segments, such as cargo transportation, made a profit of Hr 2.5 billion (73 million euros).

As we wrote in Issue 80, in March 2023, after his appointment as Ukrzaliznytsia’s new CEO for the next two years, Liashchenko got several key tasks, one of which was for the company to break even.

In September 2023, Liashchenko said that Ukrzaliznytsia was reaching break-even and would finish the first nine months of 2023 with a profit (see Issue 103). Ultimately, the company finished 2023 with a net profit of Hr 5 billion ($121 million). See Issue 127 for more detail.

On Nov. 20 2023, the Cabinet of Ministers approved Ukrzaliznytsia’s financial plan for 2024, with forecast losses of Hr 12.6 billion (€323 million). See Issue 112 for more detail.

As we wrote in September, Liashchenko said that Ukrzaliznytsia made a profit of up to Hr 3 billion ($72 million) in the first half of 2024, but lost Hr 600-700 million ($14-16 million) in July-August and expected a minor loss by the end of 2024 due to a decline in profitable types of cargo. See Issue 146 for more detail.

According to EP, liga.net, and Forbes Ukraine, Oleksandr Pertsovskyi, head of the company’s passenger business (and executive board member), is likely to become the new CEO. Pertsovskyi could be appointed as soon as this week, liga.net added.

According to EP, in addition to Liashchenko, other changes are expected on Ukrzaliznytsia’s executive board: Two seats would be cut, with these officers moving to other positions within the company. The number of executive board members would be reduced from eight to seven, with the above two positions replaced by a member in charge of HR, the media outlet wrote.

Since an independent supervisory board was established at Ukrzaliznytsia in 2018, the company has seen six CEO changes. Much of this six-year period, the company was managed by acting CEOs. Since its establishment in late 2020, the SOE Weekly has covered the four most recent CEO changes at Ukrzaliznytsia. See our Issues 19, 39, and 80 for more detail.

Ukrzaliznytsia requires substantial long-term transformation and faces several challenges. These include unbundling its different businesses, such as cargo and passenger services. It must also address its implicit public service obligation, as passenger transportation is currently loss-making and is cross-subsidised by cargo revenues. Additionally, the company needs to renew its worn-out fixed assets and prepare for competition once private companies are allowed to provide locomotive services.

In addition, Ukrzaliznytsia faces wartime challenges, including the assignment to evacuate people from areas near the frontline. To handle these issues, the company needs a permanent CEO with a long-term planning horizon.

The selection of Ukrzaliznytsia’s new supervisory board has not started, despite legal requirements. As we wrote almost three years ago, the Cabinet approved members of the railway operator’s supervisory board on Dec. 29 2021 (see our Issue 60).

Anatoliy Amelin, Alexander Doll, Jakub Karnowski, and Gebhard Hafer became independent members, while Serhiy Leshchenko, Serhiy Moskalenko and David Lomjaria were appointed as state representatives on the board.

According to the law effective at the time of appointment, as well the company’s charter, the maximum term of office of supervisory board members is three years. Thus, the tenure of the above supervisory board should expire on Dec. 28, 2024.

Since 2021, only the recent appointment of Oleksandr Kamyshin as a supervisory board member of Ukrzaliznytsia (state representative) has been known publicly. According to media reports, Kamyshin replaced Serhiy Moskalenko in this position.

At the same time, the mandatory disclosures that joint-stock companies must make according to the capital markets law and disclosure regulations of the National Securities and Stock Market Commission (NSSMC), are not available on Ukrzaliznytsia’s website. In particular, the information on company officers, such as the management and supervisory board, is missing.

Also, according to the new requirements of the SOE law (which were introduced by Law No. 3587, effective March 8 — see our Issue 122), the selection of supervisory board candidates for an SOE must begin no later than three months before the respective supervisory board member’s term of office ends (unless a decision has been made to extend his/her term of office), or no later than 10 days from the day of his/her early termination of powers.

The SOE law now also requires that such selections must follow the principles of collective suitability, board diversity, equality of requirements, professionalism, openness, and transparency.

This means that the Cabinet, as Ukrzaliznytsia’s ownership entity, should have made a decision — by Sept. 29 — to either extend the powers of the current supervisory board members or announce a selection of board members.

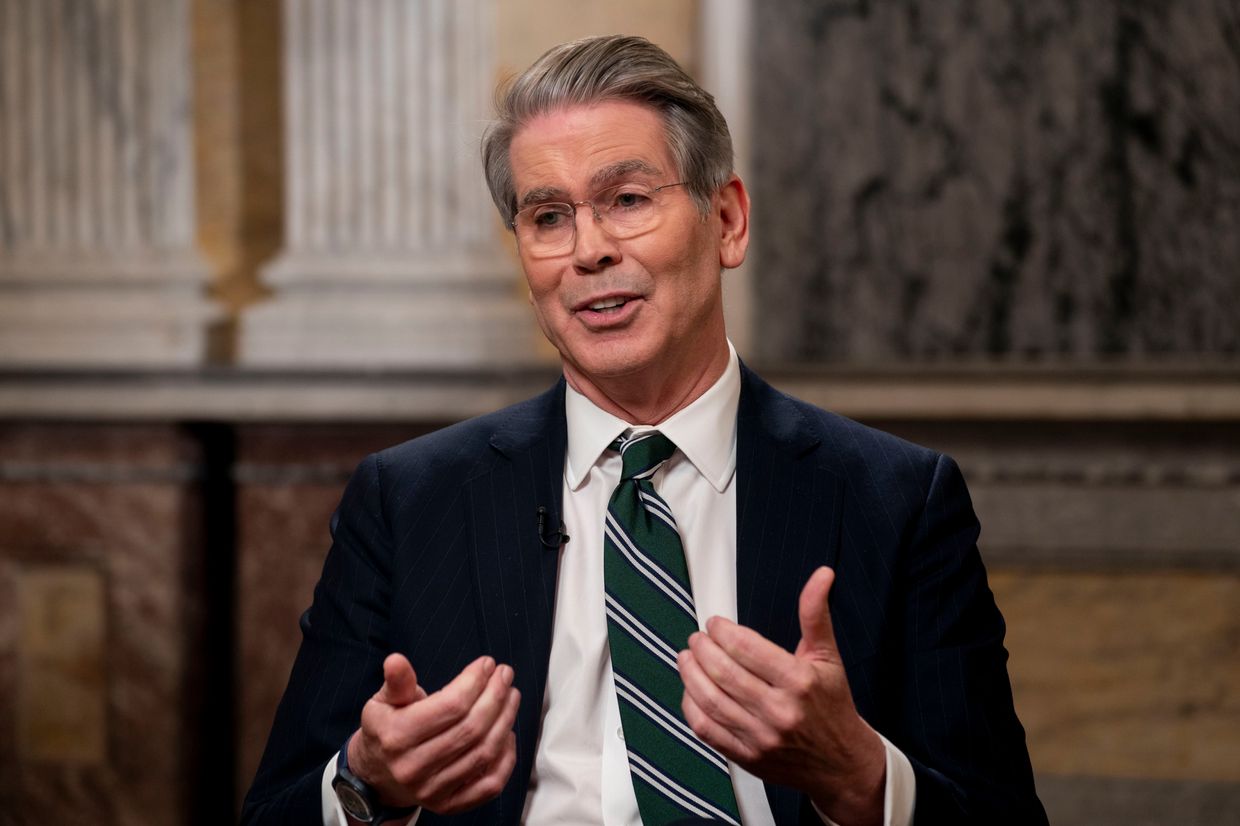

PrivatBank appoints a new CEO. On Oct. 7, PrivatBank announced that its supervisory board had elected Mikael Bjorknert (Sweden) as the bank’s new CEO, following a competitive selection that included high-calibre candidates from both Ukraine and abroad. Björknert’s candidacy is pending approval by the National Bank of Ukraine (NBU).

The bank said that Björknert has over 25 years of experience in the financial sector. Most recently, he served as head of Swedish Banking at Swedbank. Before joining Swedbank, Björknert held the position of Chairman of the Board at Swedish Bankgirot, Head of Global Transaction Services at SEB Bank, and Member of the Board at Nasdaq (Sweden).

At PrivatBank, Bjorknert will focus on advancing the bank’s customer-centric model, accelerating digital initiatives, and ensuring future-proofing, the bank added.

Preparing the bank for privatization is not listed among Bjorknert’s tasks, as it was for PrivatBank’s current CEO, Gerhard Bosch.

As we reported in late June 2024, Bosch filed his resignation notice. According to EP, the unofficial reason was the discrepancy between the tasks assigned to Bosch and the reality: When Bosch was elected as PrivatBank’s CEO in May 2021, his tasks included preparing the bank for privatization. However, during the full-scale war, this process was put on hold, EP wrote. See Issue 138 for more detail.

As we wrote in September 2024, Bosch’s contract would be terminated on Nov. 1. Forbes Ukraine then wrote that unless the winner of the competitive selection for the new CEO is determined by that time, one of the executive board members would start managing the bank as an acting CEO. (See Issue 147 for more detail.)

However, if Bjorknert is cleared by the NBU, PrivatBank will not require an interim CEO, with its competitive selection appropriately completed on time.

Competitive selection for three independent members for Ukrenergo’s supervisory board announced. On Oct. 10, the Economy Ministry announced that the SOE Nomination Committee approved the candidate requirements. The deadline to apply is Oct. 31.

As we wrote in Issue 146, on Sept. 2, Ukrenergo’s supervisory board dismissed the company’s CEO Volodymyr Kudrytskyi by a majority vote. The board appointed executive board member Oleksii Brekht as an acting CEO and decided to hold a competitive selection for a new CEO.

On the same day, Daniel Dobbeni (independent member and supervisory board chair) and Peder Andreasen (independent member) announced that they had filed their resignation notices.

“We strongly believe that the decision on the early dismissal of the CEO of Ukrenergo is politically motivated and, based on the results of the presented report, there are no valid grounds for it,” they said in a statement.

Currently, Roman Pionkowski is the only remaining independent member of the supervisory board of Ukrenergo. He was appointed together with other independent members in December 2021, meaning that his term of office should expire in December 2024.

On Sept. 10, Ukraine and the International Monetary Fund (IMF) reached a staff-level agreement on the fifth review of the four-year Extended Fund Facility (EFF) Arrangement. Subject to approval by the IMF Executive Board, Ukraine will have access to about $1.1 billion. According to the IMF’s release, the full supervisory board of Ukrenergo should be re-established by end-December 2024.

As we wrote in Issue 148, on Sept. 20, the Energy Ministry [in its capacity as Ukrenergo’s general shareholders meeting decided to hold a competitive selection for three independent members of the company’s supervisory board.

The fourth independent member will be elected in parallel under a previously launched procedure, the ministry added back then.

According to Ukrenergo’s charter, its supervisory board should consist of seven members: four independent members and three state representatives.

As we reported in June 2023, the Cabinet still had to select and approve one independent member for Ukrenergo’s supervisory board. Hence, independent members did not constitute a majority of the board, which did not meet the requirements of the law or Ukrenergo’s charter. See our Issue 95 for more detail.

As we reported in April 2024 (Issue 129), the Economy Ministry announced a competitive selection to find the lacking independent board member. See Issue 129 for more detail.

The Economy Ministry expects that by Nov. 7, the executive search consultant will have conducted a preliminary assessment of the documents, interviewed the applicants, and submitted a list of potential candidates. The selection of all board members – four independent and three state representatives – is scheduled to be completed by Dec. 9.

Privatization

UMCC finally sold. On Oct. 9, the State Property Fund of Ukraine (SPFU) sold United Mining and Chemical Company (UMCC) for Hr 3.94 billion ($95 million), just Hr 39 million ($948,000) more than the starting price of Hr 3.9 billion ($94.8 million). On Oct. 11, the Cabinet of Ministers approved the results of the auction.

The sale of UMCC was the country’s second online auction for a large-scale privatization asset in the Prozorro.Sale system, the SPFU said. The first one was Kyiv’s four-star Ukraine Hotel, which was sold for Hr 2.5 billion ($60 million). See Issue 148 for more detail.

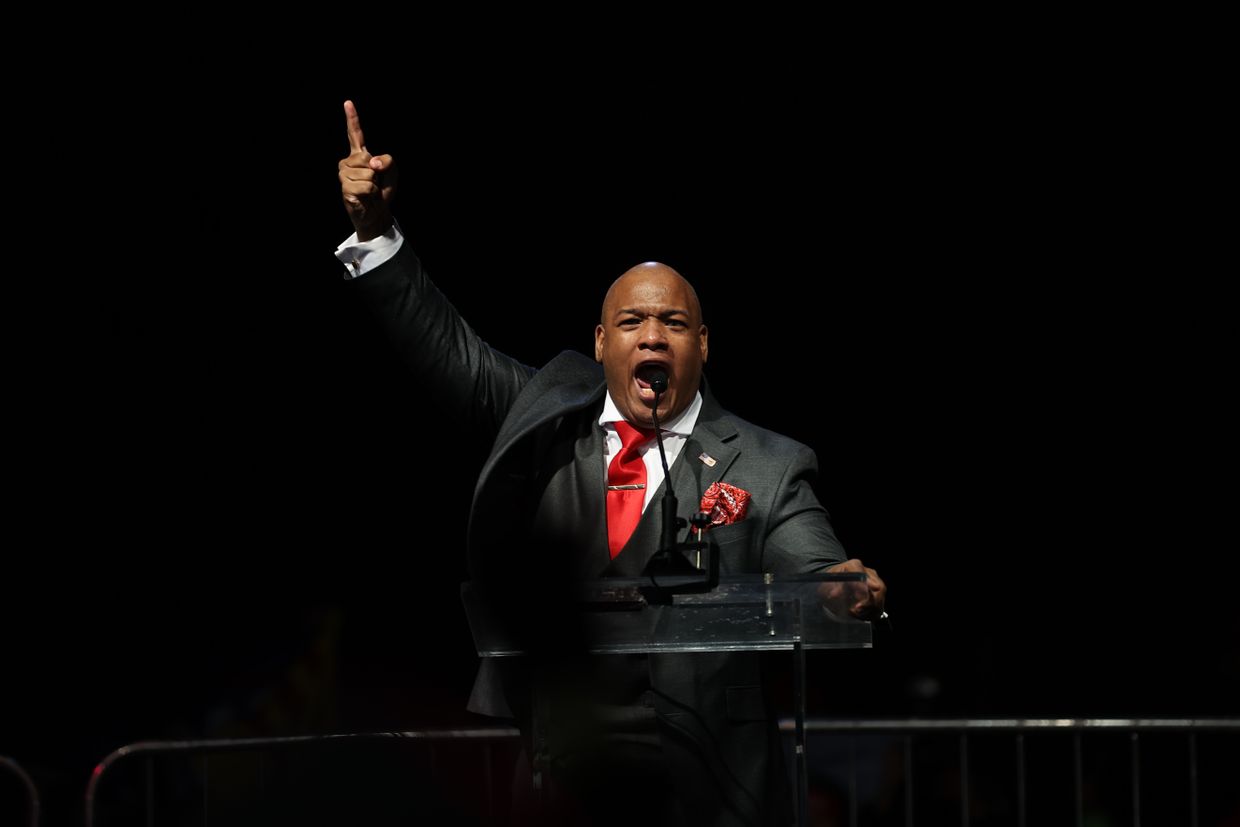

According to the SPFU and Prozorro.Sale, the only bidder, and, accordingly, the winner, is Cemin Ukraine LLC, owned by Azerbaijani businessman Nasib Hasanov.

Hasanov is the owner of the Azerbaijani NEQSOL Holding, which is known in Ukraine for being the owner of the telecom company Vodafone Ukraine. In Azerbaijan, NEQSOL also owns the telecom operator Bakcell.

Besides, NEQSOL has extensive experience in the mining business. Its subsidiary, Nobel Oil E&P, is engaged in exploration and production, while Nobel Energy provides services to oil and gas operators. NEQSOL’s oil and gas production business is concentrated in Azerbaijan, the U.S., and the U.K.

According to the privatization terms, the winner must maintain UMCC’s core business and invest at least Hr 400 million ($9.7 million) in technical re-equipment and modernization. In addition, it must pay off overdue accounts payable (Hr 609 million or $14.8 million) and wage and budget arrears, if any, at the time of transfer of ownership, the SPFU explained.

Also, 20% VAT is added to the purchase price, bringing the total value of the lot to nearly Hr 5 billion ($121 million), Oleksiy Movchan, deputy chairman of the Verkhovna Rada Committee on Economic Development, noted.

“NEQSOL aims to implement its plans to modernize, develop new products through deep processing of raw materials and expand into global markets alongside fulfilling all privatization obligations,” NEQSOL Holding’s Country Director Volodymyr Lavrenchuk said.

UMCC is Ukraine’s largest titanium ore concentrate mining and processing company. It comprises Vilnohirsk Mining and Metallurgical Plant in Dnipropetrovsk Oblast and the Irshansk Plant in Zhytomyr Oblast.

In October 2023, UMCC resumed shipments of ilmenite concentrate to the European market (see Issue 106 for more detail). The company’s net profit for the first half of 2024 was over Hr 61.6 million (1.4 million euros at the average exchange rate over that period).

This was not the first attempt to sell UMCC. As we wrote in Issue 33 three years ago, the UMCC privatization auction was scheduled to take place on Aug. 31, 2021. Later, in SOE Weekly’s Issue 41, we reported that the SPFU cancelled that auction because it only had one qualified bidder.

The media published a list of participants allegedly interested in UMCC assets. Some of them said that the asset was not well prepared for privatization, and they did not consider the auction terms fair. Others claimed that the starting price was inadequate. It was reportedly impossible to estimate the company’s mineral deposits.

The SPFU’s auction commission set Oct. 29, 2021 as the new auction date, but that auction was also cancelled (see Issue 49 for more). So was the following auction on Dec. 20, 2021 (see Issue 57 for more detail).

See more on the previous attempts to sell UMCC in our Issues 33, 41, 49, 56, and 57.

In Issue 105, we reported that the SPFU changed UMCC’s executive board, dismissing first deputy CEO Yaroslava Maksymenko and replacing her with Yegor Perelygin in September 2023. As we wrote in Issue 135, the Cabinet appointed Perelygin as UMCC’s acting CEO on June 4.

As we reported in Issue 106, the SPFU planned for UMCC to be one of the first large companies to be privatized. The starting price would be determined with BDO Corporate Finance, the SPFU’s advisor on the privatisation of UMCC.

However, as we wrote in Issue 109, then acting head of the SPFU Oleksandr Fedoryshyn said later in October 2023 that the SPFU was going to offer investors to buy UMCC in a single package with Demurinsky Mining and Processing Plant.

Vitaliy Koval, the newly appointed head of the SPFU, confirmed this later in an interview in January (see our Issue 117). In effect, this suggested that the SPFU’s previously announced plans to privatize UMCC as one of the first targets would be seriously delayed, if not put aside.

However, the SPFU’s communication on the matter in May suggested that the Fund discarded the idea of bundling UMCC and Demurinsky in a single lot. The SPFU auction commission determined the terms of UMCC’s privatisation on May 23, setting the starting price at Hr 3.9 billion (90 million euros at that time). See Issue 133 for more detail.

As we wrote in Issue 150, the National Anti-Corruption Bureau of Ukraine (NABU) completed the pre-trial investigation into the Dmytro Sennychenko case, alleging the SPFU’s former head and his accomplices of embezzling millions from state-owned enterprises, including Odesa Portside Plant (OPZ) and UMCC in 2019-2021. See our Issues 80, 83, 114, 131, and 150 for detail.

Cabinet puts seized VSMPO Titan Ukraine on privatization list. On Oct. 8, the Cabinet of Ministers added one more seized Russian company to the large-scale privatization list — the Nikopol plant of seamless titanium alloy pipes, or VSMPO Titan Ukraine.

The SPFU said that value of the company’s assets as of Dec. 31, 2023 was Hr 271.7 million ($6.6 million). The auction commission will set the starting price and terms of sale and submit them to the Cabinet for approval. After that, the date of the privatization auction will be announced, the SPFU added.

As we wrote almost two years ago (Issue 72), the High Anti-Corruption Court (HACC) seized a part of Russian oligarch Mikhail Shelkov’s Ukrainian assets, including VSMPO Titan Ukraine, in January 2023.

On Feb. 3, 2023, the HACC seized Shelkov’s another key asset, the Demurinsky Mining and Processing Plant (see Issue 74). Shortly after that, the Cabinet transferred Shelkov’s assets to the SPFU, including Demurinsky (see Issue 77).

In October 2023, then acting head of the SPFU Oleksandr Fedoryshyn said that the SPFU intended to offer investors to buy Demurinsky as a single package with UMCC (see Issue 109).

Vitaliy Koval, the newly appointed head of the SPFU, confirmed this later in an interview in January (see our Issue 117). In effect, this suggested that the SPFU’s previously announced plans to privatize UMCC as one of the first targets would be seriously delayed, if not put aside.

However, the SPFU’s communication on the matter in May suggested that the Fund discarded the idea of bundling UMCC and Demurinsky in a single lot (see Issue 133).

As we wrote in Issue 140, on July 9, the Cabinet added Demurinsky to the large privatization list.

Ukrainian SOE Weekly is an independent weekly digest based on a compilation of the most important news related to state-owned enterprises (SOEs) and state-owned banks in Ukraine.

The contents of this publication are the sole responsibility of the editorial team of the Ukrainian SOE Weekly.

The SOE Weekly is produced and financed by Andriy Boytsun. Communications support is provided and financed by CFC Big Ideas. The SOE Weekly is not financed or influenced by any external party.

Editorial team: Andriy Boytsun, Oleksiy Pavlysh, Dmytro Yablonovskyi, and Oleksandr Lysenko.