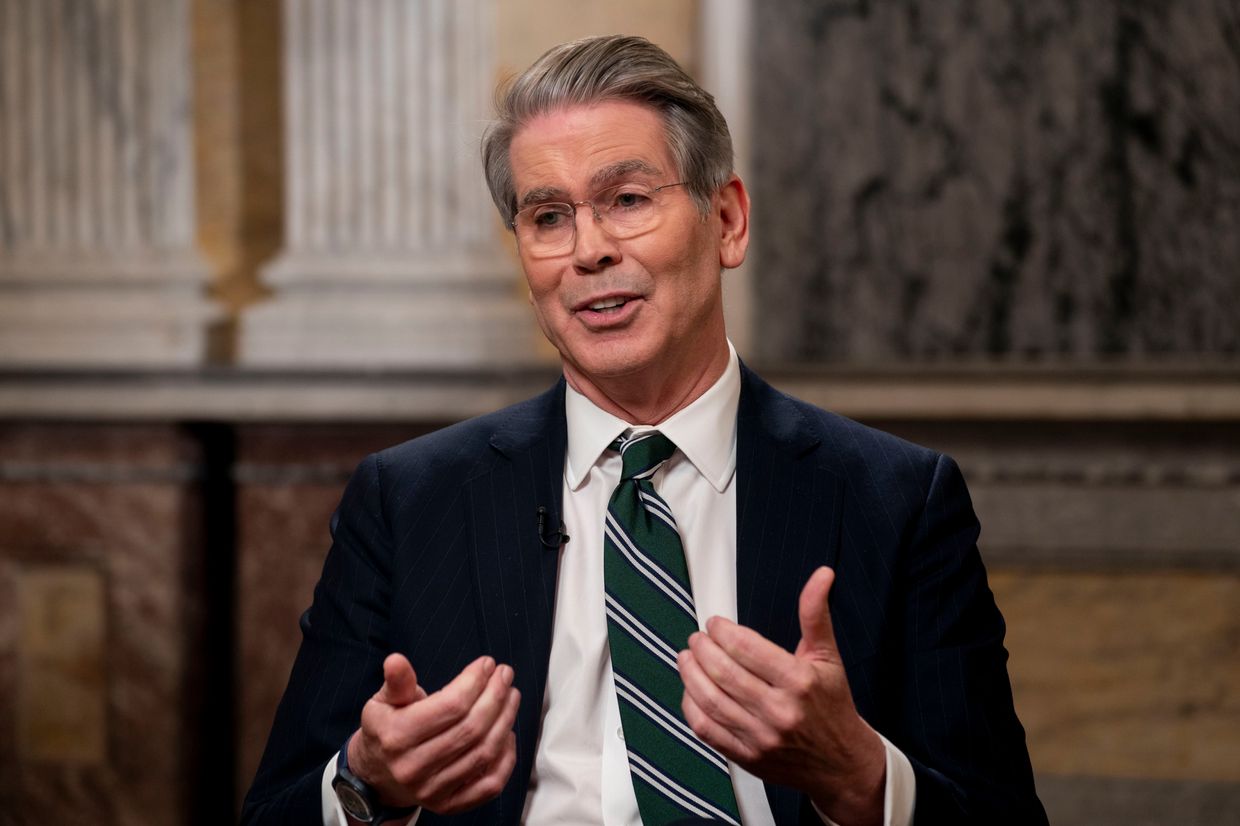

Ukraine's National Bank (NBU) will raise the key policy rate from 14.5% to 15.5% per annum starting from March 7, chairman Andrii Pyshnyi said on March 6.

The move marks the second raise of the key policy rate since the beginning of 2025. In late January, the central bank raised it from 13.5% to 14.5%.

The Ukrainian economy was heavily hit by Russia's full-scale war. At the start of the invasion, inflation skyrocketed to 26.6% in 2022 from 10.0% in 2021. It subsided the following year, but in 2024, inflation again accelerated to 12%, exceeding NBU's forecast.

According to Pyshnyi, the decision aims to maintain the "attractiveness of savings" in the hryvnia currency, the stability of the foreign exchange market, and keeping expectations under control, which will bring inflation to the 5% target.

"The NBU will be ready to take additional measures in case of further risks to price dynamics and inflation expectations," Pyshnyi said.

The NBU raised its key policy rate to 10% in January 2022. It had remained unchanged since the beginning of the all-out war, but on June 3, 2022, the rate grew from 10% to 25%. For over a year, it remained at the same level, dropping to 22% in July 2023 and following a gradual decline. In December 2024, the NBU raised the key policy rate from 13% to 13.5% in response to inflationary developments.

The central bank said that the risks "of less favorable foreign economic trends" have increased due to "further geopolitical polarization of countries" and "the corresponding fragmentation of global trade."

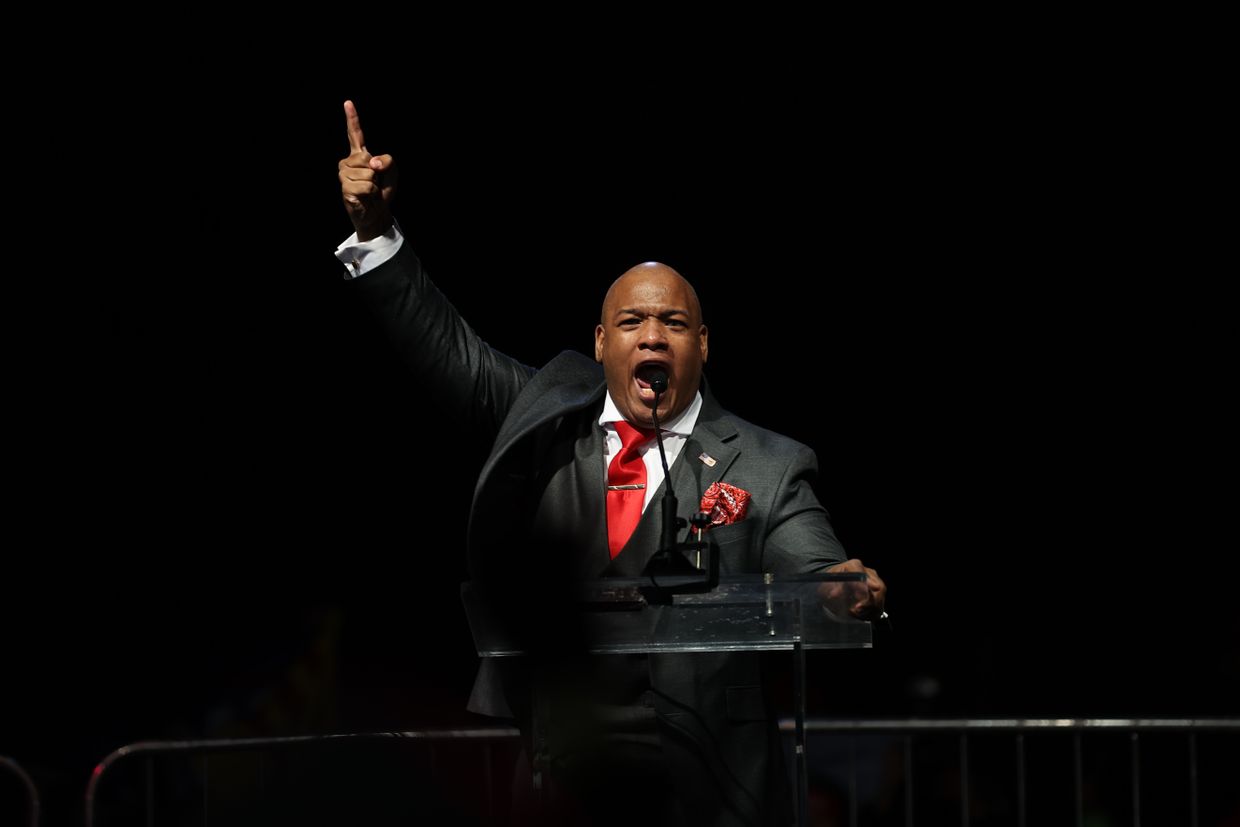

The comments come amid seismic geopolitical shifts as the U.S. under President Donald Trump has adopted an increasingly hostile stance toward Ukraine, threatened to impose tariffs against other partners, and floated the idea of deepening an economic partnership with Russia.

Although the risks to the sufficiency of international financing remain "balanced," the amount of external support confirmed for 2025 should be "sufficient" to finance the budget deficit without issuing new debt and "to maintain an adequate level of international reserves," the statement read.

"This will allow the NBU to continue to ensure a stable situation in the foreign exchange market and controllability of inflation and exchange rate expectations," the central bank said.